Friends involved in high-risk product sectors or promotional campaigns may be familiar with the following situations.

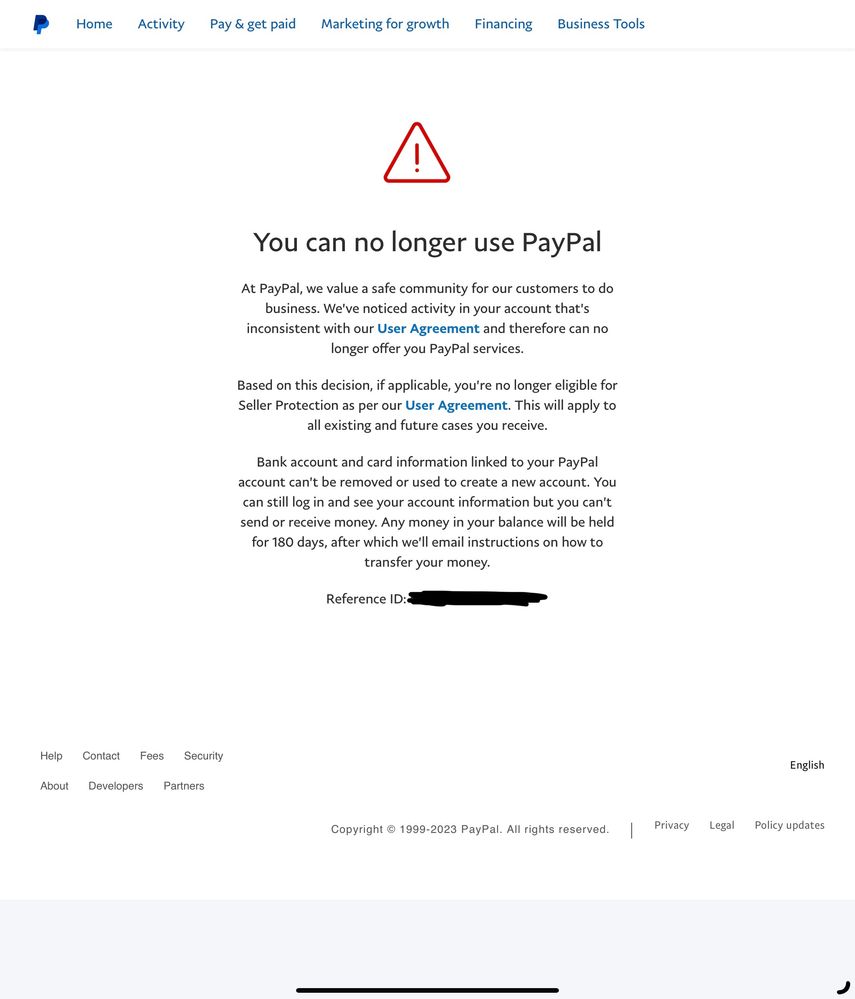

After 180 days, there is a high probability that the frozen amount will be permanently retained. Don’t rely on luck — especially for sellers involved in designer-inspired goods or high-risk seasonal campaigns.

When a seller’s PayPal account gets restricted or banned, it’s often due to improper handling at the payment level. PayPal can detect potential IP infringement, unauthorized product sales, or an increase in buyer complaints. In some cases, the issue may escalate due to involvement with GBC (General Brand Control) enforcement measures.

In recent years, due to an increase in undelivered orders or misrepresented goods, PayPal has faced a surge in complaint rates. As a result, the platform has significantly upgraded its policies and tightened its risk control measures — even for new accounts. If not managed properly, this can easily lead to account limitations or permanent holds.

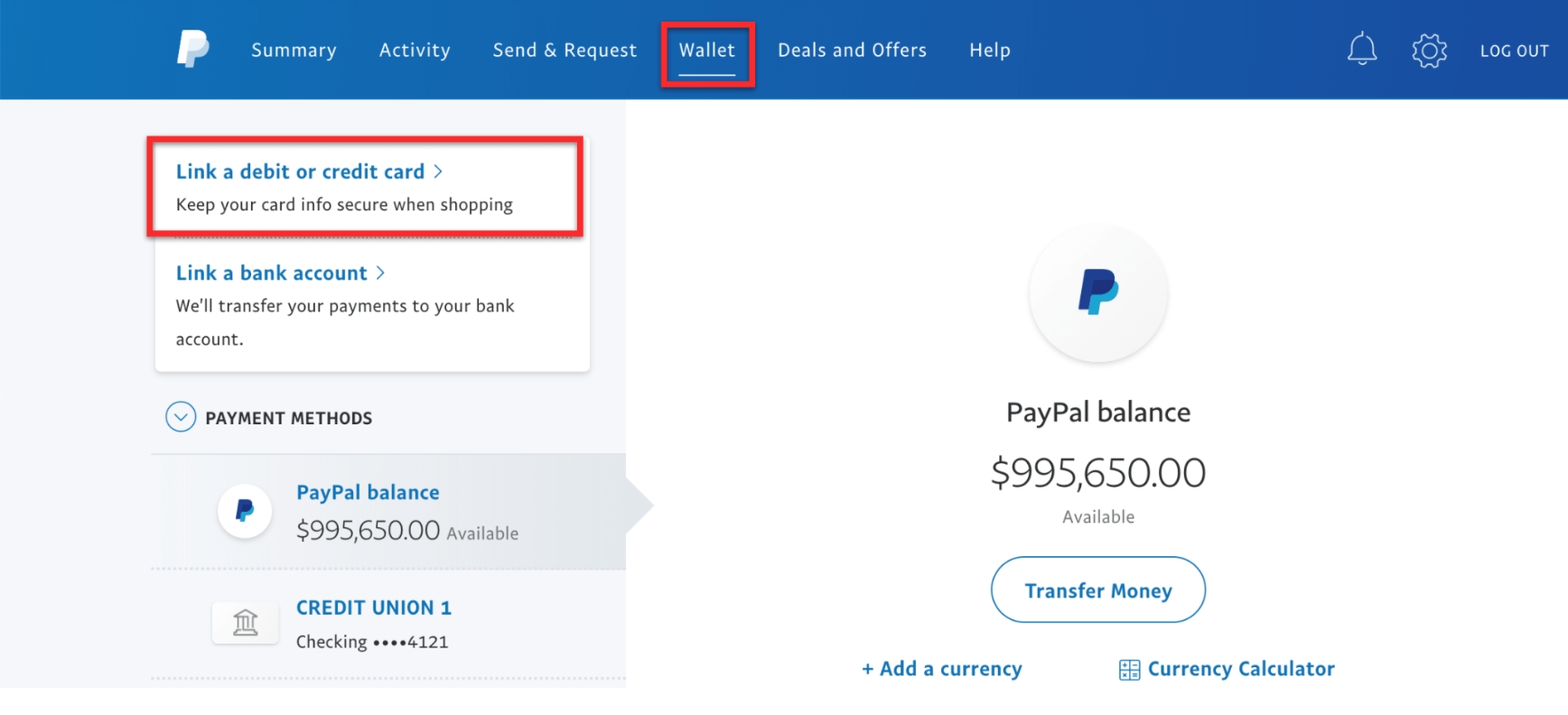

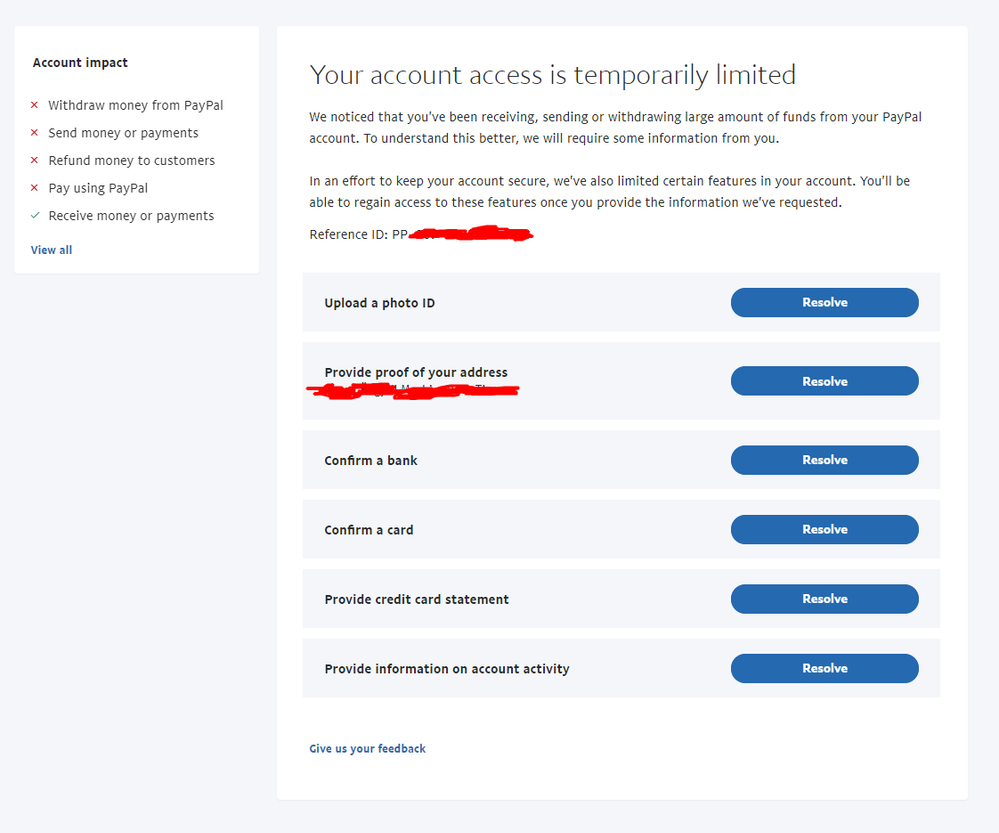

For example, one of our clients had a U.S.-based PayPal account connected to a Shopify store selling general merchandise. As soon as payments were received, the account entered a mandatory KYC (Know Your Customer) verification process.

In fact, going through KYC is a good thing. Whether you are handling general goods or third-party brand-alternative products, all new accounts must complete this step. Once the verification is passed, account stability and credibility improve significantly.

✅ What Types of PayPal Account Limitation Appeals Do We Support?

① 180-Day Holds Due to Brand Policy Violations

We accept only accounts with frozen funds over $50,000. Supporting documents such as transaction history and proof of delivery must be provided.

② General Product-Related Holds That Failed Standard Appeals

We also accept general goods accounts that failed appeals — as long as the frozen funds exceed $50,000 and necessary transaction records are available.

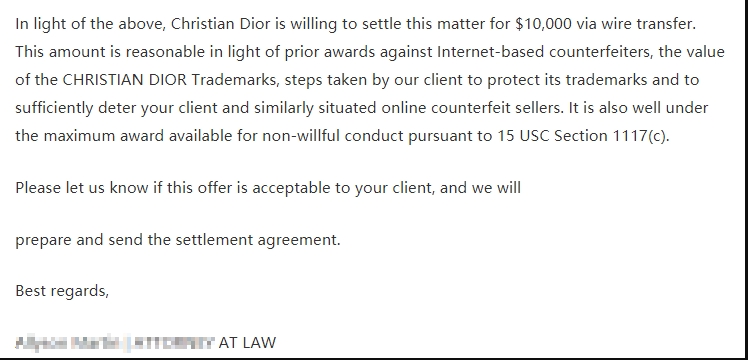

③ GBC-Flagged Enforcement Freezes (U.S. Legal Risk)

These are complex cases involving brand protection actions. We accept only accounts with frozen balances over $100,000. Please note: There is a potential failure rate. Legal and reconciliation costs — such as U.S. attorney fees — must be covered by the client.

Disclaimer:

Account holds triggered by GBC brand enforcement are not guaranteed to be lifted. If the appeal fails, clients are responsible for all legal and handling fees. Please do not proceed if you cannot accept these conditions.