Secure Online Payment Strategies for Designer-Inspired E-commerce Websites

I have been working in the designer-inspired product industry for many years, with a deep understanding of online payment solutions for independent e-commerce websites. Today, I’d like to share a comprehensive guide on this topic.

Based on payment methods, there are two categories for e-commerce in this industry:

Offline Payment

These include Western Union, MoneyGram, PayPal (offline invoice transfers), bank transfers, and cryptocurrencies such as Bitcoin and Ethereum. These options offer very limited protection for buyers. Once payment is made, there are no guarantees—if a buyer is unsatisfied or doesn’t receive the item, they typically have no recourse.

PayPal offline invoice transfers are relatively safer for sellers, but not entirely risk-free. Sellers must closely manage customer satisfaction metrics—product quality, shipping times, and overall service—to avoid disputes. PayPal tends to side with buyers during disputes, and even if you use invoices, refund claims are highly likely when issues arise.

Western Union and MoneyGram offer no buyer protection and are generally used only for repeat customers who have a high level of trust in your service and product quality. For new customers, these methods are rarely accepted. Additionally, PayPal invoices, while secure, are inefficient for sellers due to the need for manual confirmation of each order. As a result, this method is better suited for a “chat order” sales model with limited daily orders, and not ideal for automated online transactions on a website.

Online Payment

Online payment systems are valued for their efficiency, automation, and scalability. Many of my clients have experienced significant success using online platforms, where dozens or even hundreds of orders come in after a TikTok live or Facebook ad campaign. Clearly, it’s impractical to manually handle each order through chat.

For independent stores selling designer-inspired or look-alike products, common payment gateways include PayPal, Stripe, and credit cards. However, these platforms have strict policies and regularly flag or suspend accounts associated with non-official branded goods. To mitigate this, you’ll need to implement technical measures on your site.

The “AB Website” Payment Model

A widely adopted solution is the AB site model. This involves two websites:

Site A: Your main store (selling designer-inspired goods)

Site B: A secondary site listing general merchandise

When a buyer places an order on Site A, they are redirected to Site B for payment. Site B handles the payment process through PayPal or Stripe, referencing a generic product, which helps reduce risk.

But is this enough?

Absolutely not.

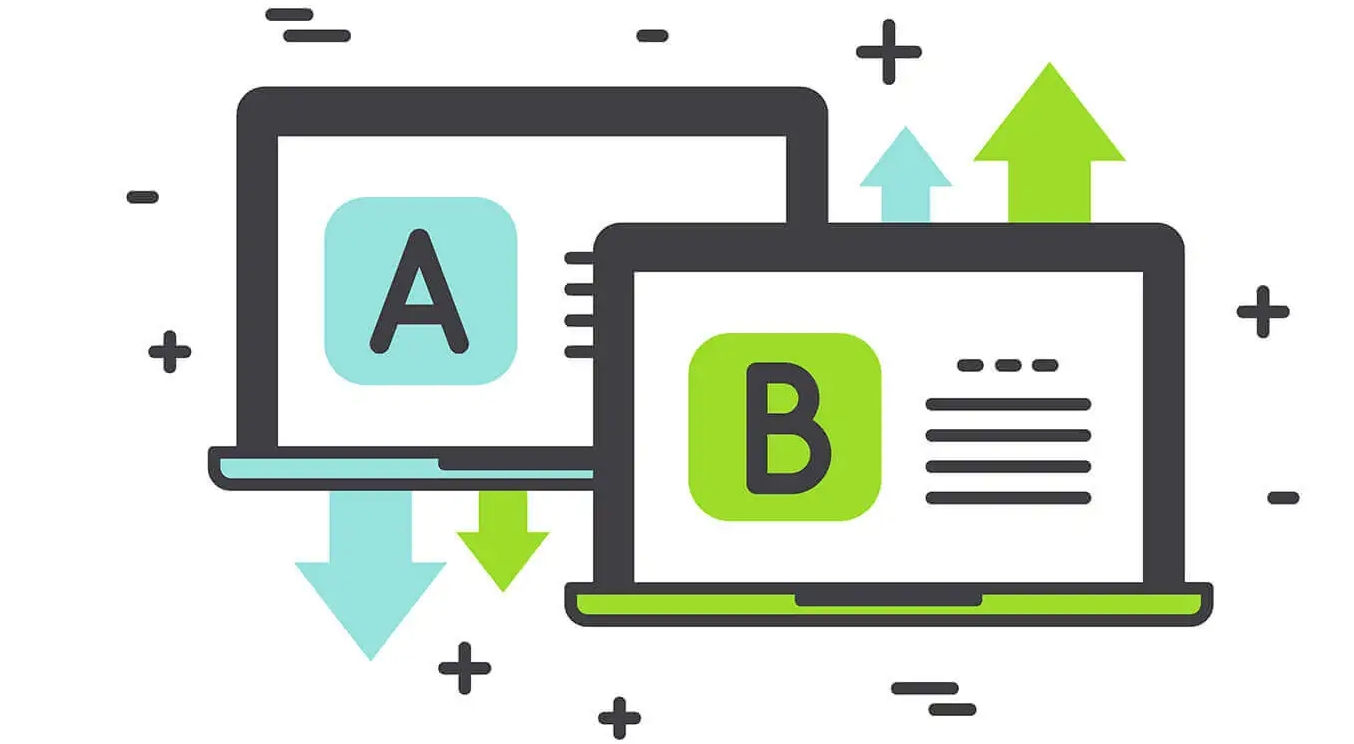

PayPal and Stripe have robust detection systems and can uncover this kind of masking strategy.

Advanced Payment Security Measures

To further obscure activity, many sellers implement a “polling switch payment” system. This means using multiple payment accounts and rotating between them to distribute transactions. You can configure each account with randomized rules, such as:

Geographic region of payment

Payment time slots

Order quantity and value ranges

This reduces the chance of one account being flagged for suspicious activity.

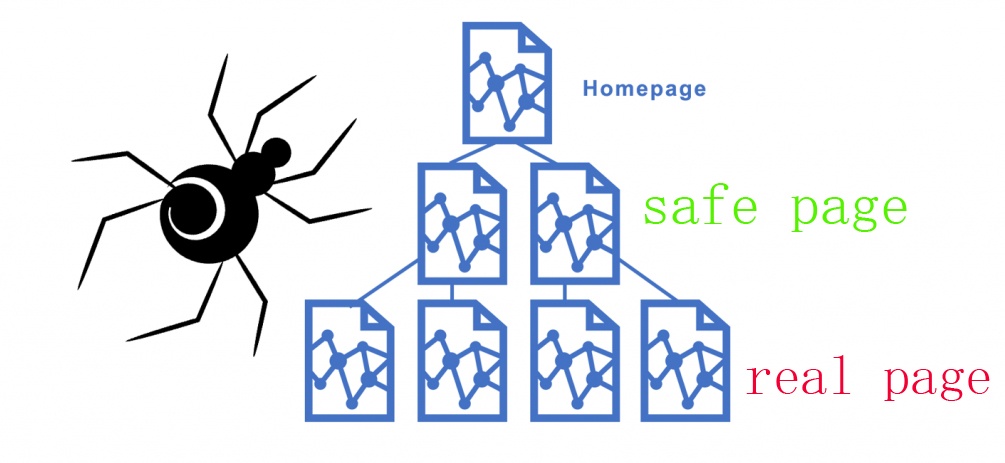

Crawler Detection System

Another key security layer is deploying a crawler/spider recognition module. This system detects whether the site visitor is a payment gateway bot (such as PayPal’s automated systems) or a genuine customer.

The detection process identifies suspicious IP headers and saves them in a “crawler IP database”. Over time, this list becomes more accurate. Once a known IP visits again, the system instantly recognizes and handles it accordingly.

Cloaking & Redirects

Upon detecting a PayPal or Stripe spider, do not simply return a 404 page. Instead, use cloaking technology to redirect it to a safe, neutral landing page. This approach significantly lowers the risk of your payment account being flagged or reviewed.

Risk Control Against Blacklisted Buyers

Besides protecting against automated detection, your system should also track high-risk buyers—those who frequently dispute transactions. Log their phone numbers, delivery addresses, names, and other data. If a suspicious buyer places an order, the system can trigger a risk alert.

Additionally, identifying GBC (Global Buyer Compliance) behavior is an essential layer of your fraud prevention system, helping you avoid external payment threats.

Conclusion

These technical layers form the foundation of secure and scalable payment processing for designer-inspired e-commerce websites. Over the past 8 years, I have remained deeply involved in optimizing such systems and have successfully helped many businesses overcome payment-related challenges in this niche market.